How Many Jobs Are Available in Real Estate Investment Trusts?

Real estate investment trusts (better known as REITs) are where real estate meets the stock market.

They own, manage, or finance income-producing properties, and most of their profits flow back to investors through dividends. That setup keeps hiring steady across roles in asset management, finance, operations, and property services.

Globally, estimates suggest that REITs support over 1 million jobs, both directly and through connected industries like construction and maintenance. In the U.S., the sector accounted for about 3.5 million full-time jobs in 2023, generating more than $277 billion in labor income.

And in 2026, the number of jobs available in real estate investment trusts continues to grow as new funds expand portfolios and competition for skilled talent rises.

If you’re thinking about building a career in this space or growing your team inside a REIT, now’s a great time to understand where the real opportunities lie.

Let’s break it down clearly, shall we?

TL;DR

- REITs employ hundreds of thousands of professionals across different functions.

- Beyond direct hires, they support millions more through contractors and related services.

- At any given time, you’ll find plenty of open roles across the sector.

- Major employers include global REIT leaders in logistics, retail, data centers, and healthcare.

- Growth areas include technology-driven assets, sustainability initiatives, and healthcare real estate.

- Entry points are diverse, covering finance, property management, compliance, operations, and corporate support.

What’s the Current Job Availability in Real Estate Investment Trusts?

When you look at jobs available in real estate investment trusts, the numbers vary depending on the source. What’s consistent is that REITs employ a large workforce directly and support millions of indirect jobs.

At any given time, candidates can usually find a steady flow of openings across finance, property operations, compliance, and leadership.

But let’s get deeper:

Estimated Job Numbers and Market Size

The numbers may vary a bit depending on the source, but they all point to the same reality: real estate investment trusts are a major employer.

According to the National Association of Real Estate Investment Trusts (Nareit), REITs directly employed about 331,000 full-time professionals in the U.S. in 2023, generating more than $31 billion in labor income.

That number grows fast when you include everyone connected to the ecosystem: contractors, service providers, and partner firms that keep REIT operations running.

Meanwhile, IBISWorld placed the figure closer to 196,000 employees in 2024, which aligns with Nareit’s range once you factor in different reporting methods.

Either way, the message is the same: this is a big, active sector that continues to create opportunities.

For job seekers, the most practical takeaway is that there are usually 1,000 to 2,000 jobs available in real estate investment trusts at any given time. Positions range from analyst and finance roles to operations, compliance, and senior management.

Job Growth Trends

Hiring in REITs keeps evolving as the market expands and priorities shift.

One of the biggest drivers right now is the rise of new asset types, especially data centers and telecom towers. These properties need people with both technical know-how and solid financial skills, making them some of the most in-demand areas in the industry.

Another strong factor is sustainability. REITs are hiring more engineers, compliance officers, and project managers to meet growing expectations around ESG standards, energy efficiency, and green building certifications.

At the same time, as more REITs go global, they’re looking for professionals who understand cross-border finance, tax, and asset management. That mix of local insight and international perspective is quickly becoming a must-have.

And the numbers confirm it:

- According to Business Research Insights, the REIT market was valued at USD 2.12 billion in 2024 and is projected to reach USD 4.94 billion by 2033, growing at a 9.9% CAGR.

- The North American REIT market is expected to grow at about 3.03% CAGR between 2025 and 2030.

- As IBISWorld also reported, employment in U.S. REITs grew by an average of 2.1% annually from 2019 to 2024.

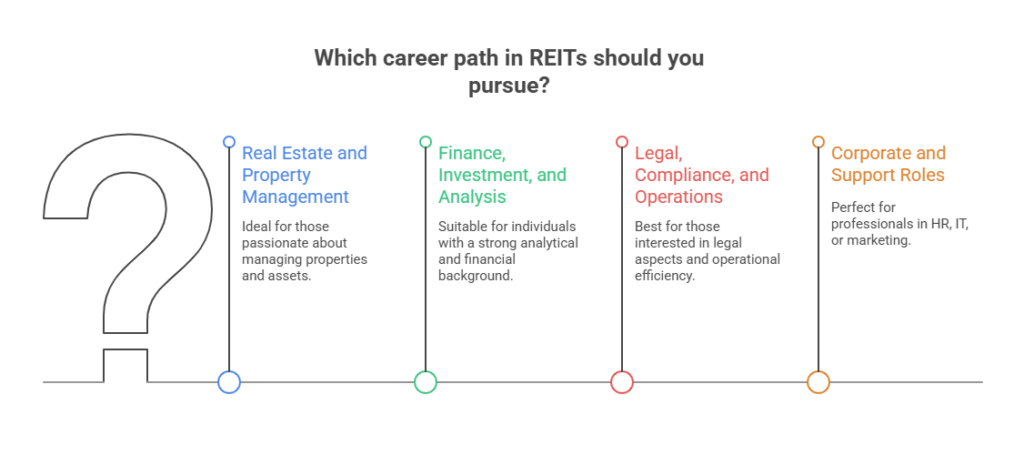

Common Career Paths in REITs

The world of jobs available in real estate investment trusts is broader than most people think. Sure, there are finance and investment experts, but that’s just the start.

REITs also rely on people who keep properties running day to day, handle legal details, make sure regulations are met, and manage the tech that keeps everything moving.

That’s what makes this industry so interesting. It attracts experienced real estate pros who know the market, but also welcomes talent from other fields. That includes people from finance, engineering, marketing, or operations who want a fresh challenge in a stable, fast-growing sector.

Here’s a quick breakdown of where those career paths usually lead:

Real Estate and Property Management Roles

These are the jobs that keep REIT portfolios running smoothly day after day. They’re the backbone of the business: making sure every property performs, tenants stay happy, and investors see consistent returns.

If you’re hands-on and like seeing the results of your work, these are the roles to look at:

- Asset Manager: Leads the long-term strategy for each portfolio, analyzing performance and deciding when to hold, sell, or reinvest to meet investor goals.

- Property Manager: Oversees tenant relationships, maintenance, and day-to-day operations that keep properties efficient and profitable.

- Leasing Consultant: Focuses on filling spaces, negotiating lease terms, and maintaining occupancy levels to secure steady revenue for the REIT.

Finance, Investment, and Analysis Roles

If numbers are your language, REITs offer plenty of space to put those skills to work. These positions drive how capital is allocated, where it grows, and how the portfolio performs over time.

Here’s where finance professionals make their mark:

- Financial Analyst: Builds detailed models, forecasts, and valuations that guide acquisitions and investment decisions.

- Portfolio Manager: Balances risk and return by deciding how capital is spread across property types and markets.

- Acquisitions Associate: Scouts new opportunities, conducts due diligence, and executes property purchases that expand the REIT’s footprint.

Legal, Compliance, and Operations Roles

REITs operate under strict rules, so compliance and smooth coordination are essential. These roles keep everything on track: legally, financially, and operationally speaking.

If you’re detail-oriented and like structure, this is where you’ll fit best:

- Legal Counsel: Advises on contracts, acquisitions, partnerships, and any disputes tied to property or corporate matters.

- Compliance Officer: Ensures every transaction and disclosure meets SEC, IRS, and other regulatory standards.

- Operations Coordinator: Manages workflows and systems that connect teams and keep regional operations running efficiently.

Corporate and Support Roles

Behind every successful REIT is a team that keeps people, processes, and communication aligned. These roles strengthen culture, technology, and investor confidence.

If you’re more business-focused, these paths might be for you:

- HR Professional: Leads recruiting, training, and retention efforts to help REITs attract and develop top talent.

- IT Specialist: Oversees technology systems, from cybersecurity and data management to property software solutions.

- Marketing and Communications Manager: Builds investor confidence through branding, public relations, and clear reporting for shareholders.

Skills and Qualifications for REIT Careers

To stand out in the jobs available in real estate investment trusts, you need a mix of academic preparation, technical expertise, and interpersonal skills.

Employers are looking for candidates who can combine financial and operational knowledge with the ability to communicate and adapt in a fast-changing sector.

Let’s see what they look for:

Educational Backgrounds

Most REIT positions call for a strong academic base. Degrees in finance, business, law, or real estate are common, especially for analysts, acquisitions specialists, or compliance officers.

Candidates with MBAs often stand out for leadership and strategic roles, since these programs develop the mix of management and technical skills REITs look for at higher levels.

Professional certifications like CFA (Chartered Financial Analyst) or CCIM (Certified Commercial Investment Member) can also open doors to senior positions and show a serious commitment to the field.

Technical and Analytical Skills

REIT employers highly value people who are comfortable with numbers, data, and systems.

Financial modeling, market analysis, and valuation are must-haves for investment and acquisitions teams. Meanwhile, tools like Excel, Argus, and valuation software are part of daily work for analysts and portfolio managers.

Beyond finance, data literacy is becoming essential, especially in REITs that manage logistics, data centers, or specialized assets. Being able to interpret performance metrics and operational data helps guide smart business decisions.

Soft Skills Employers Value

Technical skills may get you in the door, but soft skills keep you moving forward. REITs hire people who can think fast, communicate clearly, and adapt as the market shifts. Here are the qualities that make the biggest difference:

- Communication: Ability to explain complex ideas simply and build trust with investors, tenants, and colleagues.

- Negotiation: Knowing how to find win-win outcomes in leases, partnerships, or deals.

- Adaptability: Staying focused and flexible when markets, interest rates, or regulations change.

- Collaboration: Working smoothly with cross-functional teams spread across different markets.

- Organization: Managing multiple projects and priorities without losing track of key details.

In a field that changes as quickly as real estate, professionals who bring this mix of people skills and practical judgment stand out and move up fast.

Salary Expectations and Career Growth

Salaries in REITs reflect the scale of the industry and the responsibility that comes with each role. It’s a field where performance and experience pay off; sometimes, quite literally.

Average Salary Ranges by Role

According to Salary.com, as of October 2025, the average annual salary for REIT employees in the U.S. sits around $100,681, or roughly $48 per hour. Most professionals earn between $88,000 and $114,000, depending on their department, experience, and location.

At the top of the ladder, the numbers rise fast. Presidents and CEOs can earn anywhere from $595,000 to $982,000 a year. That’s without counting stock options or bonuses, which are common parts of senior compensation packages.

Simply put, the financial upside is real. Those who build long-term careers in REITs often enjoy stability, strong benefits, and steady income growth over time.

Career Progression and Advancement Opportunities

Most people in REITs start in analyst, leasing, or coordinator roles before moving into management positions.

From there, career paths can lead to director-level or executive roles in areas like acquisitions, portfolio management, or compliance.

Growth in this industry depends less on tenure and more on results. The professionals who climb fastest are those who deliver consistent performance, manage assets effectively, and show they can handle complex operations across multiple properties or markets.

Factors that Influence Pay

Several factors shape how compensation works in REITs:

- Company size: Global REITs usually pay more than regional or niche firms, given their larger portfolios and higher capital flow.

- Experience and specialization: Professionals skilled in acquisitions, asset management, or sustainability-related projects often earn premium salaries.

- Market conditions: Interest rates, property performance, and investor returns can all impact profitability. And, in turn, employee pay.

In short, pay in REITs follows the same logic as the properties they manage: the stronger the performance, the higher the return.

How to Start a Career in a Real Estate Investment Trust?

Getting into the REIT world doesn’t always mean having years of experience under your belt. Many firms hire entry-level talent straight out of school, while others welcome professionals making a switch from finance, law, or property management.

Here’s how most people start (and grow) a career in this field:

Entry Points for New Graduates

For recent graduates, the best way in is through internships, analyst programs, or assistant roles.

Internships give early exposure to areas like asset management or acquisitions and often turn into full-time offers. Analyst programs, on the other hand, are more structured. They teach financial modeling, property valuation, and market analysis skills needed for senior investment roles down the road.

Assistant positions in operations or property management are also solid entry points. They offer a hands-on look at how REITs run day to day, which is valuable for anyone aiming to move into asset management or development later on.

Career Transitions from Other Fields

You don’t have to come from real estate to succeed in REITs. In fact, many professionals arrive from finance, law, or property management and bring skills that translate perfectly.

Finance or investment banking backgrounds fit naturally into acquisitions or capital markets. Lawyers often move into compliance or general counsel roles, where contract and regulation expertise really matters.

Even experienced property managers from the private sector often step into REITs to handle larger, institutional-grade portfolios.

These transitions are common, and a big reason why REITs attract such diverse talent.

Networking and Industry Certifications

Building a strong network can open doors that a résumé alone can’t.

Attend industry conferences, join professional associations, and stay in touch with specialized recruiters who focus on real estate investment.

Certifications can also make a real difference. Designations like CFA (Chartered Financial Analyst), CPA (Certified Public Accountant), or CCIM (Certified Commercial Investment Member) show technical credibility and commitment to the field.

They’re not required for every role, but they can help your profile stand out—and speed up career progression once you’re in.

Challenges and Opportunities in the REIT Job Market

Like any industry, the jobs available in real estate investment trusts come with both challenges and opportunities.

The good news? If you know how to handle both sides, you can build a long, rewarding career in the field.

Key Challenges Facing REIT Professionals

Interest rates are one of the biggest hurdles. When they rise, they can directly impact REIT valuations and slow down acquisitions. Staying agile and understanding how financing shifts affect portfolios is key.

Regulation is another factor that keeps professionals on their toes. Compliance with SEC and IRS rules takes constant attention and precision.

Operationally, the competition for high-quality assets is fierce. REITs have to stand out through smarter strategy, stronger data use, and tighter execution. That pressure sometimes slows hiring in certain areas, even as others expand.

Opportunities for Career Growth

On the flip side, REITs offer plenty of room to grow, especially for those who know where to look.

Sustainability is one of the biggest growth engines right now. Companies are investing heavily in energy efficiency, green certifications, and ESG reporting, which has opened doors for engineers, analysts, and compliance specialists alike.

Another strong area is data-driven asset management, particularly within logistics and data center portfolios. And as REITs continue expanding globally, professionals with international finance, tax, or property law experience are finding more opportunities than ever.

Skills that Differentiate Top Performers

In today’s REIT market, success comes down to being both skilled and adaptable. Technical expertise is essential, but flexibility, curiosity, and cross-functional thinking are what set people apart.

- Digital literacy: Comfort with modeling tools, analytics platforms, and property technology helps you stay ahead.

- Financial agility: Understanding how markets and capital structures shift gives you an edge in acquisitions and portfolio roles.

- Cross-functional mindset: The best performers can bridge finance, operations, and compliance, all by turning complex processes into smooth results.

In short, REITs reward professionals who can think strategically, move fast, and keep learning as the market changes.

Make Your Next Step Count in Real Estate

If you’ve been wondering where real estate and finance actually meet, this is it. REITs bring both worlds together, and they’re full of real opportunities for people who want to build something solid.

This isn’t a niche corner of the industry anymore. Now, it’s a growing ecosystem that rewards people who stay sharp, adapt fast, and keep learning as the market shifts.

If you want to take that next step with a team that knows the business inside out, we’re here for that. At Estate Skyline, we help real estate professionals and firms connect the right talent with the right roles, so both sides grow stronger.

Ready to move your career or your team forward? Reach out to us today.

FAQs

How many jobs are available in real estate investment trusts?

In the U.S., direct employment usually falls between 200,000 and 330,000 professionals, and there are typically 1,000 to 2,000 open positions at any given time. It’s a steady market with room for both newcomers and experienced talent.

How big is the REIT industry?

The REIT market was worth about USD 2.12 billion in 2024 and is projected to reach nearly USD 5 billion by 2033. That kind of growth shows how strong (and global) the sector has become.

Is a real estate investment trust a good career path?

Absolutely. REITs offer job stability, competitive pay, and clear room to grow. If you’re drawn to finance, property operations, or asset management, this is one of the few real estate sectors where you can build a long-term career.

How much do REITs pay employees?

On average, REIT employees in the U.S. earn around $100,000 a year. Senior executives can make several hundred thousand dollars annually, plus bonuses and stock options that boost total compensation even further.

How much can I earn working in a REIT?

It depends on your role and experience. Analysts and managers typically earn strong mid-market salaries, while senior executives and portfolio heads can reach the high six-figure range. Performance and results play a big role in pay progression.

How can I get into real estate investment trusts?

The most common entry points are analyst programs, property management roles, and internships. Building a strong network, earning certifications like CFA or CCIM, and attending industry events can help you stand out and open doors faster.

Are REITs good for beginners?

Yes. For graduates or early-career professionals, REITs offer hands-on learning, exposure to large-scale portfolios, and multiple paths for growth. It’s a great place to start if you want a career that combines real estate with long-term stability.

- TL;DR

- What’s the Current Job Availability in Real Estate Investment Trusts?

- Common Career Paths in REITs

- Skills and Qualifications for REIT Careers

- Salary Expectations and Career Growth

- How to Start a Career in a Real Estate Investment Trust?

- Challenges and Opportunities in the REIT Job Market

- Make Your Next Step Count in Real Estate

- FAQs